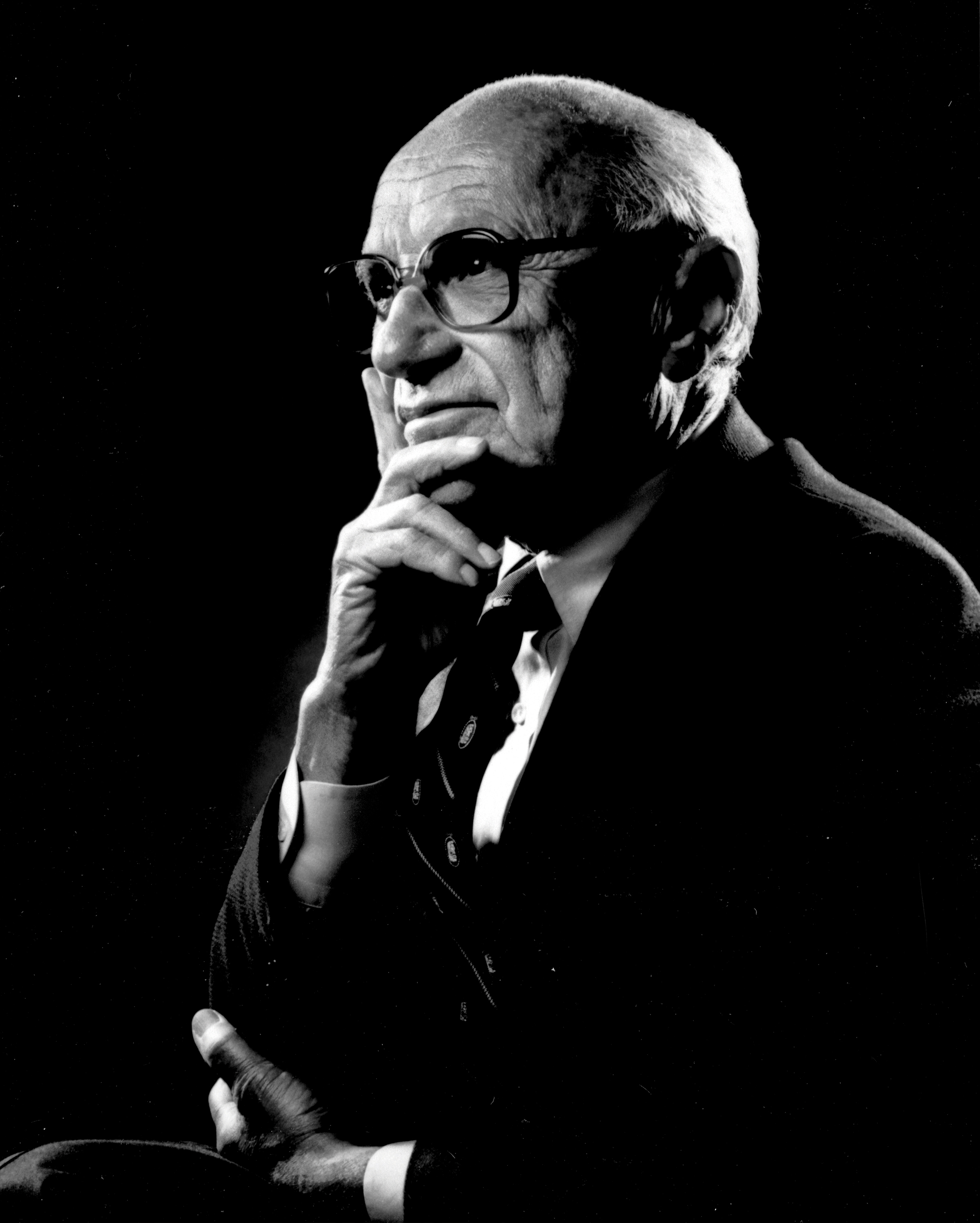

Milton Friedman najznámejšie citáty

History suggests only that capitalism is a necessary condition for political freedom. Clearly it is not a sufficient condition. Fascist Italy and Fascist Spain, Germany at various times in the last seventy years, Japan before World Wars I and II, tzarist Russia in the decades before World War I -- are all societies that cannot conceivably be described as politically free. Yet, in each, private enterprise was the dominant form of economic organization. It is therefore clearly possible to have economic arrangements that are fundamentally capitalist and political arrangements that are not free. Even in those societies, the citizenry had a good deal more freedom than citizens of a modern totalitarian state like Russia or Nazi Germany, in which economic totalitarianism is combined with political totalitarianism. Even in Russia under the Tzars, it was possible for some citizens, under some circumstances, to change their jobs without getting permission from political authority because capitalism and the existence of private property provided some check to the centralized power of the state. (en)

Potvrdené výroky, Kapitalizmus a sloboda (1962)

Zdroj: FRIEDMAN, Milton. Capitalism and Freedom. 3rd Edition, Chicago; Londýn : University of Chicago Press, 2002. 208 p. ISBN 0-226-26421-1. p. 10.

War is a friend of the state. In time of war, government will take powers and do things that it would not ordinarily do. (en)

Friedman vysvetlil prečo je militaristická zahraničná politika Bushovej administratívy hrozbou pre jeho snahy zoštíhľovania štátnej správy.

Potvrdené výroky

Zdroj: LOCHHEAD, Carolyn. Friedman's 'heresy' hits mainstream / Private Social Security accounts were his idea. http://www.sfgate.com/opinion/article/Friedman-s-heresy-hits-mainstream-Private-2665465.php#page-2 In San Francisco Chronicle. ISSN 1932-8672, 2005-06-05 [cit. 2014-01-09].

I am an agnostic. I do not "believe in" God, but I am not an atheist, because I believe the statement, "There is a god" does not admit of being either confirmed or rejected. I do not believe God has anything to do with economics. But values do. (en)

Potvrdené výroky

Zdroj: LOFTON, John. An Exchange: My Correspondence With Milton Friedman About God, Economics, Evolution And “Values”. http://archive.theamericanview.com/index.php?id=736 American View. 2006 [cit. 2014-01-12].

Milton Friedman Citáty o ľuďoch

One of the great mistakes is to judge policies and programs by their intentions rather than their results. We all know a famous road that is paved with good intentions. The people who go around talking about their soft heart — I share their — I admire them for the softness of their heart, but unfortunately, it very often extends to their head as well, because the fact is that the programs that are labeled as being for the poor, for the needy, almost always have effects exactly the opposite of those which their well-intentioned sponsors intend them to have. (en)

Potvrdené výroky

Zdroj: The Open Mind : Living Within Our Means. http://www.thirteen.org/openmind/public-affairs/living-within-our-means/494/ [epizóda televíznej talkshow]. Moderátor Richard D. Heffner. Spojené štáty, 1975. WPIX, 1975-12-07 10:30 EST.

Potvrdené výroky

Indeed, the major source of objection to a free economy is precisely that it does this task so well. It gives people what they want instead of what a particular group thinks they ought to want. Underlying most arguments against the free market is a lack of belief in freedom itself. (en)

Potvrdené výroky, Kapitalizmus a sloboda (1962)

Zdroj: FRIEDMAN, Milton. Capitalism and Freedom. 3rd Edition, Chicago; Londýn : University of Chicago Press, 2002. 208 p. ISBN 0-226-26421-1. p. 15.

Milton Friedman citáty a výroky

With respect to teachers' salaries, the major problem is not that they are too low on the average — they may well be too high on the average — but that they are too uniform and rigid. Poor teachers are grossly overpaid and good teachers grossly underpaid. Salary schedules tend to be uniform and determined far more by seniority, degress received, and teaching certificates acquired than by merit. (en)

Potvrdené výroky, Kapitalizmus a sloboda (1962)

Zdroj: FRIEDMAN, Milton. Capitalism and Freedom. 3rd Edition, Chicago; Londýn : University of Chicago Press, 2002. 208 p. ISBN 0-226-26421-1. p. 95.

Potvrdené výroky

Zdroj: MŰHLFENZLOVÁ, Isabell. Milton Friedman: Čím víc je svobody, tím lepší je život. http://hn.ihned.cz/3-18602890-Friedman-500000_d-79 In Hospodářské noviny. ISSN 1213-7693. 2006-06-05 [cit. 2014-01-09]. (Český preklad pôvodného interview pre nemecké noviny Handelsblatt)

As it happens, I was opposed to going into Iraq from the beginning. I think it was a mistake, for the simple reason that I do not believe the United States of America ought to be involved in aggression. (en)

Potvrdené výroky

Zdroj: VARADARAJAN, Tunku. Rose and Milton Friedman : The Romance of Economics. http://online.wsj.com/news/articles/SB115352827130914276 In The Wall Street Journal. ISSN 0099-9660, 2006-12-22 [cit. 2014-01-09].

Nemal som nič spoločné s ich vládou. Vrúcne si prajem, aby boli nahradené slobodnou demokratickou spoločnosťou. Nepovažujem návštevu žiadneho z nich za súhlas s nimi. Nepovažujem učenie sa z ich skúseností za nemorálne. Nepovažujem poskytnutie rád ohľadne ekonomickej politiky za nemorálne, keď sú podľa mňa také podmienky, že ekonomický vzostup by prispel ako k blahobytu obyčajných ľudí, tak aj k šanci na posun smerom k politicky slobodnej spoločnosti.

Let me stress again. I do not approve or condone the regimes in Chile, Brazil, Yugoslavia or Russia. I had nothing to do with their establishment. I would fervently wish their replacement by free democratic societis. I don not regard visiting any of them as an endorsement. I don not regard learning from their experience as immoral. I don not regard giving advice on economic policy as immoral if the conditions seem to me to be such that economic improvement would contribute both to the well-being of the ordinary people and to the chance of movement toward a politically free society. (en)

Potvrdené výroky, Two Lucky People (1998)

Zdroj: FRIEDMAN, Milton – FRIEDMAN, Rose. Two Lucky People : Memoirs. University of Chicago Press, 1998. 660 p. ISBN 0-226-26414-9. p. 596. (odpoveď na list Augusta Pinocheta, 21. apríl 1975)

Štátne výdavky teraz dosahujú 40 percent národného dôchodku, nerátajúc priame výdavky prostredníctvom regulácií a pod. Pokiaľ zahrniete aj tie, vyjde vám približne polovica. Reálne riziko, ktorému čelíme je že sa toto číslo bude postupne zvyšovať. Jediným efektívnym spôsobom, ako ho udržať dole je obmedziť objem štátnych príjmov. To možno učiniť znížením daní.

I am in favor of cutting taxes under any circumstances and for any excuse, for any reason, whenever it's possible. The reason I am is because I believe the big problem is not taxes, the big problem is spending. The question is, “How do you hold down government spending?” Government spending now amounts to close to 40% of national income not counting indirect spending through regulation and the like. If you include that, you get up to roughly half. The real danger we face is that number will creep up and up and up. The only effective way I think to hold it down, is to hold down the amount of income the government has. The way to do that is to cut taxes. (en)

Potvrdené výroky

Zdroj: HAWKINS, John. An Interview With Milton Friedman. http://www.rightwingnews.com/interviews/an-interview-with-milton-friedman-2/. 2003-09-16 [cit. 2014-01-09].

Milton Friedman: Citáty v angličtine

“Governments never learn. Only people learn.”

Statement made in 1980, as quoted in The Cynic's Lexicon : A Dictionary Of Amoral Advice (1984), by Jonathon Green, p. 77

One role of prohibition is in making the drug market more lucrative.

America's Drug Forum interview (1991)

Zdroj: (1962), Ch. 1 The Relation Between Economic Freedom and Political Freedom, 2002 edition, page 15

“Society doesn't have values. People have values.”

From Created Equal, an episode of the PBS Free to Choose television series (1980, vol. 5 transcript) http://www.freetochoosemedia.org/broadcasts/freetochoose/detail_ftc1980_transcript.php?page=5.

Zdroj: (1962), Ch. 3 The Control of Money, p. 50

Zdroj: Free to Choose (1980), Ch. 1 "The Power of the Market", page 13

Kontext: The key insight of Adam Smith's Wealth of Nations is misleadingly simple: if an exchange between two parties is voluntary, it will not take place unless both believe they will benefit from it. Most economic fallacies derive from the neglect of this simple insight, from the tendency to assume that there is a fixed pie, that one party can gain only at the expense of another.

As quoted in If Ignorance Is Bliss, Why Aren't There More Happy People? (2009) by John Mitchinson, p. 87

"Milton Friedman" in William Breit and Roger W. Spencer (ed.) Lives of the laureates

Lecture "The Suicidal Impulse of the Business Community" (1983); cited in Filters Against Folly (1985) by Garrett Hardin ISBN 067080410X

“The problem in this world is to avoid concentration of power - we must have a dispersion of power.”

Milton Friedman - Big Business, Big Government http://www.youtube.com/watch?v=R_T0WF-uCWg

Zdroj: Money Mischief (1992), Ch. 2 The Mystery of Money

Zdroj: Money Mischief (1992), Ch. 2 The Mystery of Money

“One reason why money is a mystery to so many is the role of myth or fiction or convention.”

Zdroj: Money Mischief (1992), Ch. 2 The Mystery of Money

Zdroj: (1962), Ch. 13 Conclusion, 2002 edition, p. 198

Zdroj: Free to Choose (1980), Ch. 1 "The Power of the Market", p. 14

Zdroj: Money Mischief (1992), Ch. 2 The Mystery of Money

Introduction

Capitalism and Freedom (1962)

Kontext: The free man will ask neither what his country can do for him nor what he can do for his country. He will ask rather "What can I and my compatriots do through government" to help us discharge our individual responsibilities, to achieve our several goals and purposes, and above all, to protect our freedom? And he will accompany this question with another: How can we keep the government we create from becoming a Frankenstein that will destroy the very freedom we establish it to protect? Freedom is a rare and delicate plant. Our minds tell us, and history confirms, that the great threat to freedom is the concentration of power. Government is necessary to preserve our freedom, it is an instrument through which we can exercise our freedom; yet by concentrating power in political hands, it is also a threat to freedom. Even though the men who wield this power initially be of good will and even though they be not corrupted by the power they exercise, the power will both attract and form men of a different stamp.

Milton Friedman - Big Business, Big Government http://www.youtube.com/watch?v=R_T0WF-uCWg

"The Methodology of Positive Economics" (1953)

Zdroj: Capitalism and Freedom (1962), Ch. 13 Conclusion

Interview with Richard Heffner on The Open Mind (7 December 1975)

Zdroj: Capitalism and Freedom (1962), Ch. 6 The Role of Government in Education, p. 95

As quoted in The Money Masters (1995)

“You must distinguish sharply between being pro free enterprise and being pro business.”

Milton Friedman - Big Business, Big Government http://www.youtube.com/watch?v=R_T0WF-uCWg